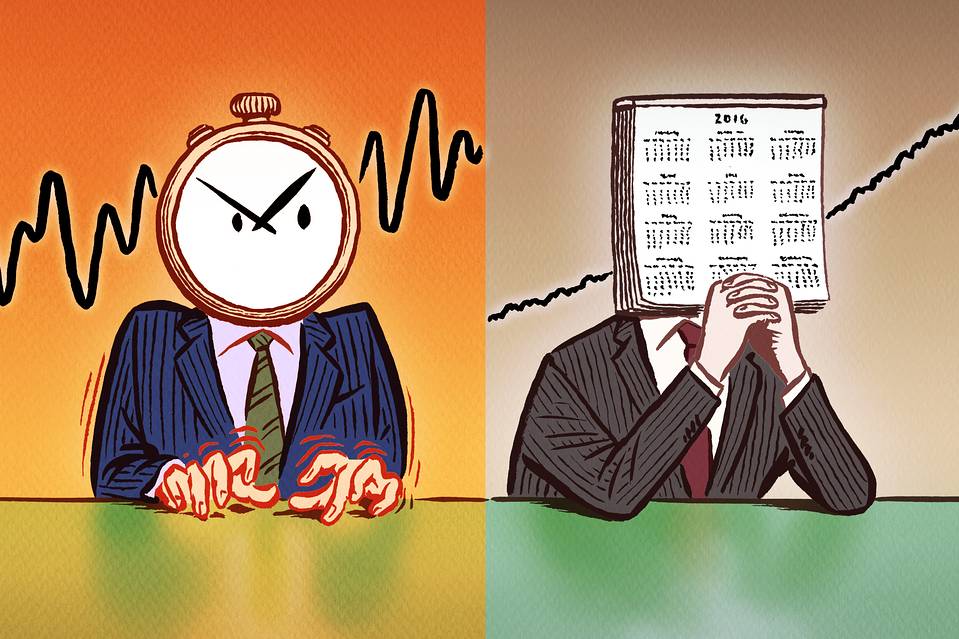

If you plan to put money into the stock market, then you should know where you’re headed and how to get there. In short, you need to be an Investor, not a Speculator.

Over the years, I have had A LOT of friends ask me about getting into the market, thinking that they can make the right “bets” and make a quick buck. Thing is, now they’re asking 36 year old Chris who has been doing this for 17 years. They’re not asking 19 year old E-4 Chris who saved up $500 to open a Scottrade account to trade stocks in his NAS Coronado barracks room and thought he was going to retire in 10 years.

19-year old E-3 me fit the model of a Speculator. A Speculator is someone who fits one of two profiles. The first is someone who is inexperienced and places “bets” on stocks that they “think” or “feel” will go up. I was in the military, so naturally I was attracted to stocks that sold components to the military. I found, what I believed, was the greatest company on the edge of military technology. They had contracts to manufacture miniature OLED displays for close-up viewing that gave a wide-viewing angle for use in multiple weapons systems like planes, helicopters, and the futuristic “Land Warrior” system the Army was developing at the time. Add to that the two year old war in Afghanistan and the hot-off-the-press Iraq War and I thought I had the biggest winner of all time. Even better, it was a penny stock!

I speculated and lost all of my money. By that time, I was emotionally involved in the stock, and deposited another $500 as soon as I could…and promptly lost that, too. But I knew something that nobody else knew and saw something in this company that nobody else saw…so I lost another $500. Ultimately, the stock was de-listed from the exchanges and the company went bankrupt. Had I known what I was doing, I wouldn’t have made those bets. It was pure speculation.

The second profile of a Speculator is actually someone who has a more complete knowledge of the market and individual stocks. Most are very intelligent and, for the most part know what they’re talking about. Think if Warren Buffett was couldn’t control his impulses and threw money around like a crazy person. So, we’re going to ignore this type of Speculator.

Fast forward to E-5 Chris still trying to play the market and enter AM1. I was done with most of my daily tasks in VS-41’s Quality Assurance department and pulled up my Scottrade account when AM1 walked in behind me and asked what I was doing. After an “Oh, umm…,” he calmed me down and asked me to explain to him what I had money in and why.

He listened to my thoughts, said “that’s a pretty good way of thinking” and then proceeded to give me names of people to read about and financial magazines to pick up at the NEX. Thus began my journey to becoming an Investor.

What makes an Investor are two things: 1) education and 2) a strategy. Education doesn’t have to be a formal academic training. Just sponge up as much information as you can and never stop. Read recommended books (I’ve listed two at the end of this) and magazines. I started with an issue of Personal Finance back in 2004 and I’m now near the completion of an M.B.A. (thanks, GI Bill!).

Take my word for it: you don’t need an MBA or an MS in Finance. There is nothing I’m learning right now that you can’t get for a fraction of the cost at Amazon or Barnes & Noble. The MBA has other unique advantages.

After education, you need a strategy. This comes from asking questions like “what is my time horizon” or “what is my personal risk profile?” Most importantly, what is your goal? Investing for retirement is a bit different than investing for your kids’ college education.

Your strategy will pay off if you use the right tactics and have PATIENCE. I have a lot of money invested right now and a change of a few percentage points can move my portfolio thousands of dollars, but I didn’t start here. This is from 17 years of constantly and religiously investing 10% of what I get in my paycheck…and years of losing money because I didn’t know what I was doing.

I educated myself, came up with a strategy that works for me, and I stick to it. TIME has been my best friend because of the Compounding effect of the market on my portfolio. I’m going to keep sticking to it and, yes, I’m still working and putting away money. It’s a marathon, not a sprint!

I realize that I didn’t say much in the way of how to pick investments, but we’re just not there, yet. Baby steps.

Book Recommendations:

-The Intelligent Investor by Benjamin Graham

-Finance (Barrons Business Review) by Angelico Groppelli Ph.D. and Ehsan Nikbakht DBA CFA

-University Textbooks on the subject of Finance

One thought on “Speculating vs Investing”

Comments are closed.